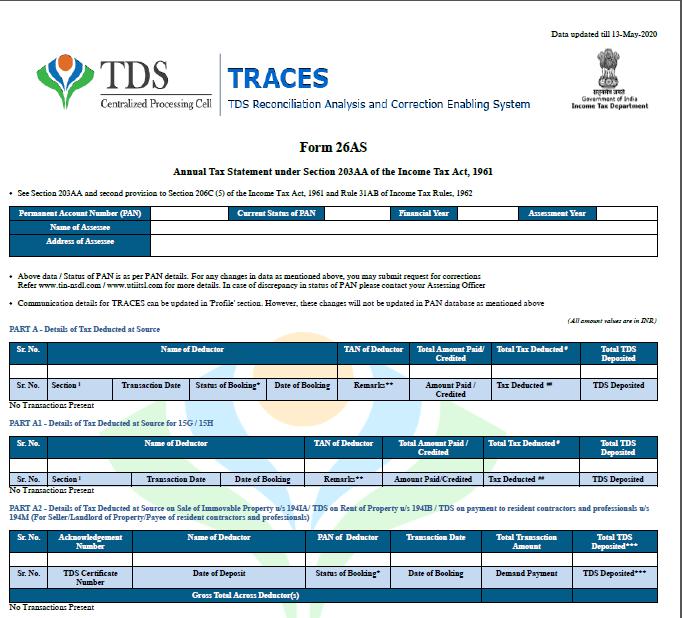

Default in payment of TDS, penalty paid for the default, etc.High value transactions pursued through banking and financial institutions, as per the Annual Information Report (AIR) filed by the institutions.Refunds received from the Income Tax department.Payment of advance tax or self-assessment tax.The details of deduction would be mentioned by the seller in Form 26AS. If the taxpayer has purchased an immovable property over a value of Rs.50 lakhs during a particular year, he/she needs to deduct tax at source from the consideration paid to the seller.What is Form 26AS?įorm 26AS is a combined annual statement of a taxpayer, in which tax credits of a taxpayer are maintained by the Income-tax Department. Form 26AS consists of details such as tax deducted by entities on the taxpayers’ behalf, details of income on which tax have been deducted, details of deductors, etc. In this article, we look at Form 26AS in detail. Form 26AS indicates details of TDS, TCS, tax paid by an assessee and confirmation from banks that the taxes have been received. Step 12: Your Form 26AS will appear on the screen.Learn » Income Tax » Form 26AS Form 26AS – Income Taxįorm 26AS is an Annual Tax Statement under section 203AA issued by the Income Tax Department. Various formats, such as HTML, Text, or PDF can be selected. Step 10:Select the 'Assessment Year' and ‘View type'. Step 9: Click on proceed and select the ‘View Tax Credit (Form 26AS)' Step 8: You must have to agree to the usage and acceptance of the Form. Step 7: After confirming the above option, you will reach the TDS-CPC Portal. Step 6: Click on the ‘View Form 26 AS (Tax Credit)' option. Step 5: After that, select the ‘File Income Tax Return'. Step 4: Go to the file section and select the 'Income Tax Returns' option from there. Step 2: Log in to your account using your User ID (that is either your PAN or Aadhar Number).

Step 1: Go to the income tax portal and click on log in. Here are some steps to easily download Form 26AS on the new Income Tax Portal. So if you're looking to download Form 26AS on the new Income Tax Portal, we've got you covered. Along with this, many old options have also been changed. More options are now available on the e-filing portal. From the looks of the page to some features, a lot has changed on the new portal.

0 kommentar(er)

0 kommentar(er)